NEW YORK (TheStreet) -- I've never been a big fan of Facebook (FB), definitely not the stock, and perhaps to a lesser extent, the application. The stock is ridiculously priced at 208 times trailing earnings, 48 times 2014 consensus earnings estimates, more than 10 times book value, and 18 times revenue. Keep in mind that these sentiments are from a value investor, who simply can't fathom those multiples, and growth investors would make the argument that those measures are irrelevant in Facebook's case. [Read: Dramatic 48-Hour Shift in Apple Sentiment] Indeed, the stock has been on a tear since mid-July, following a better-than-expected quarter after an aggressive push into mobile advertising, and shares are up nearly 80% since then. The stock has finally managed to eclipse its intraday high of $45 from its very first day of trading on May 12, 2012. The company now boasts of having more than 1 million advertisers; that's impressive, and one of the reasons that investors are re-engaged.

FB data by YCharts

FB data by YCharts

There is no doubt that some investors have made money from owning the stock, and I am not discounting the possibility that shares may run even higher. We've seen countless examples of overvalued companies continuing to head higher, well beyond their true value. It's yet another example of the inefficiencies that make the markets and investor psychology so fascinating. Investors will continue to buy names, such as Facebook, that are priced for perfection.

In the past few days, two things happened, neither of which relates to the company's financials, that have me again questioning Facebook's prospects. Granted these are completely anecdotal in nature, and their relevance is more from the gut, than from the mind. In fact, I was not even planning on writing about Facebook today, but can't help myself. The first thing was an article in our newspaper entitled "Facebook's Fall From Cool," written by a local high school student. In the article, the young author proclaims that Facebook has become an "obligation," as opposed to a "source of entertainment." Now, that may be nothing new. The article itself caused me to quiz my own teenagers, who told me in no uncertain terms, that kids have turned away from Facebook, and would rather use Twitter or Instagram. [Read: Understanding Obamacare: 4 Things You Need to Know ] Now, the fact that Facebook bought Instagram last September is certainly not lost on me. The question is, when will the kids also tire of Instagram, and what will take its place? Perhaps Facebook will be the force behind the next hot social media application, but that is presuming a lot.

The second thing that happened, which has dampened the little enthusiasm I had remaining for Facebook itself, was a series of posts by one of my own Facebook friends, who is a very decent guy.

Two days ago, he mentioned that he'd be undergoing a colonoscopy, likening it to April 15 -- tax day. That was fine, actually funny, but still much more than I, or anyone else needs to know.

Then late yesterday came the recap of the procedure, four paragraphs worth. Too much information, and enough to sour me from logging on, and reading about anyone's latest medical exploits, or how little Billy can now recite pi out to 400 decimals. They should perhaps rename it "Bragbook," or "TooMuchInformationIDon'tCareAboutBook."

Mark Zuckerberg has publicly stated that he never intended for Facebook to be cool. But I can't help but question the growing, albeit anecdotal, sentiment of Facebook fatigue. This does not mean that the company won't continue to earn millions of dollars. It just means, that in my view, it is hard to make the case that the company, currently valued at $112 billion, is worth more than either McDonald's (MCD), or Home Depot (HD), or DuPont (DD) and Walgreen (WAG) combined. There's often a disconnect between price and value, and we may once again be seeing it here. My gut could certainly be wrong, it would not be the first time. Follow @JonMHellerCFA This article is commentary by an independent contributor, separate from TheStreet's regular news coverage.

At the time of publication, Heller had no positions in stocks mentioned. Jonathan Heller, CFA, is president of KEJ Financial Advisors, his fee-only financial planning company. Jon spent 17 years at Bloomberg Financial Markets in various roles, from 1989 until 2005. He ran Bloomberg's Equity Fundamental Research Department from 1994 until 1998, when he assumed responsibility for Bloomberg's Equity Data Research Department. In 2001, he joined Bloomberg's Publishing group as senior markets editor and writer for Bloomberg Personal Finance Magazine, and an associate editor and contributor for Bloomberg Markets Magazine. In 2005, he joined SEI Investments as director of investment communications within SEI's Investment Management Unit. Jon is also the founder of the Cheap Stocks Web site, a site dedicated to deep-value investing. He has an undergraduate degree from Grove City College and an MBA from Rider University, where he has also served on the adjunct faculty; he is also a CFA charter holder.

Popular Posts: 5 Dividend ETFs Doling Out Monthly DividendsHow to Play The Natural Gas Deal of the CenturyMPC Scores Major Win With Hess Deal Recent Posts: 5 Midcap Energy Stocks to Buy Now Bitcoin Bounces Back! – Morning Linkfest (May 30) 5 Dividend ETFs Doling Out Monthly Dividends View All Posts

Popular Posts: 5 Dividend ETFs Doling Out Monthly DividendsHow to Play The Natural Gas Deal of the CenturyMPC Scores Major Win With Hess Deal Recent Posts: 5 Midcap Energy Stocks to Buy Now Bitcoin Bounces Back! – Morning Linkfest (May 30) 5 Dividend ETFs Doling Out Monthly Dividends View All Posts  Midcaps — firms with market caps between $2 billion and $10 billion — could be the sweet spot for energy investors. That's because midcaps offer the best attributes of large- and small-cap stocks. Typically, midcaps benefit from strong cash flows, stable business models and less volatility than smaller equities. There's plenty of strong dividend potential as well. On the other hand, midcaps are just small enough to grow faster than their larger counterparts.

Midcaps — firms with market caps between $2 billion and $10 billion — could be the sweet spot for energy investors. That's because midcaps offer the best attributes of large- and small-cap stocks. Typically, midcaps benefit from strong cash flows, stable business models and less volatility than smaller equities. There's plenty of strong dividend potential as well. On the other hand, midcaps are just small enough to grow faster than their larger counterparts. The offshore contract drilling sector is dominated by larger firms like Transocean (RIG) and Noble (NE). However, with a market cap of just $3 billion, Atwood Oceanics (ATW) could be in the sweet spot for investors looking at midcap energy stocks.

The offshore contract drilling sector is dominated by larger firms like Transocean (RIG) and Noble (NE). However, with a market cap of just $3 billion, Atwood Oceanics (ATW) could be in the sweet spot for investors looking at midcap energy stocks. Refiners live and die by their margins. If crack spreads are too tight, profits are dwindled down to nothing. Luckily for midcap refiner HollyFrontier (HFC), it's still enjoying pretty juicy margins on its refined products.

Refiners live and die by their margins. If crack spreads are too tight, profits are dwindled down to nothing. Luckily for midcap refiner HollyFrontier (HFC), it's still enjoying pretty juicy margins on its refined products. Ask any investor to name the hottest shale formations in the U.S. and odds are the words Bakken and Eagle Ford would be at the top of their lists. Add in the prolific Permian Basin and you have a trifecta of shale oil and natural gas liquids (NGLs) that can power profits for years to come.

Ask any investor to name the hottest shale formations in the U.S. and odds are the words Bakken and Eagle Ford would be at the top of their lists. Add in the prolific Permian Basin and you have a trifecta of shale oil and natural gas liquids (NGLs) that can power profits for years to come. It takes a lot of technology and know-how in order to drill in the ultra-deep water of the world. For the energy stocks providing those services, it can mean some huge profits. For Remotely Operated Vehicles (ROVs) specialist Oceaneering International (OII), it can mean record profits.

It takes a lot of technology and know-how in order to drill in the ultra-deep water of the world. For the energy stocks providing those services, it can mean some huge profits. For Remotely Operated Vehicles (ROVs) specialist Oceaneering International (OII), it can mean record profits. What a difference a few years can make. After getting killed by low natural gas prices, Ultra Petroleum (UPL) has bounced back with a vengeance. Yet more good times could be in store for the midcap energy stock.

What a difference a few years can make. After getting killed by low natural gas prices, Ultra Petroleum (UPL) has bounced back with a vengeance. Yet more good times could be in store for the midcap energy stock.

Jim Arbogast/Getty ImagesCamping is one of the more inexpensive summer vacation options for families. With summer comes thoughts of travel: road trips and theme parks and visits to Grandma's house, camping and cruising and hanging out by the pool. The most organized of families, of course, have already made their summer vacation plans. But for those of us who haven't yet decided, or hyper-organized families who are already thinking about next year, we've got some excellent ideas. The good news is you don't have to be rich to enjoy a great family vacation. "A lot of people have in their mind that a family vacation has to cost a lot of money," says Jody Halsted, who shares travel tips at FamilyRambling.com and has been traveling with kids since the first of her two daughters was 3 months old. "It can cost a lot of money, but it doesn't have to." How much a family vacation costs depends on a lot of variables, starting with how long you plan to vacation and whether you will drive or fly. Choice of lodging also makes a big difference, as does what you plan to do and where you plan to eat. And, of course, it depends on where you start your trip. "If people are on a budget, they really should be looking at destinations they could drive to," says Suzanne Rowan Kelleher, the family vacations expert at About.com. A road trip can be a vacation in itself, not just a means to an end. Arm the kids with cameras and let them photograph the World's Largest Ball of Twine or the World's Largest Pistachio Nut, share their photos on social media and create collages when they return home. "A road trip is the perfect family vacation," says Tamela Rich, an author who spends much of her time on road trips. "It's not about going to a destination and forking over money. It's what you do on the way." She suggests letting older kids research and plan what to see and where to eat along the way. She likes the Roadside America (for Apple devices only) and History Here (for both Apple and Android devices) apps for finding unusual sights and historical markers. If your dates are flexible, you can save money. Hotels in large cities are often cheaper over the weekend, but a resort may offer better rates midweek. Extended-stay hotels or vacation rentals let you cook meals. Some chain hotels provide free breakfasts, and a picnic in the park is cheaper than lunch in a restaurant. "If you're eating out three meals a day, that's going to really add up," Kelleher says. Admission fees to theme parks, zoos and attractions can be costly. Check with local tourist offices and websites for destination-city deals and coupon books as well as information on free events. The Entertainment Book, which is significantly discounted now that it's the middle of the year, offers lots of two-for-one coupons for local attractions. Choosing a destination where lots of attractions are free, such was Washington, D.C., also cuts costs. And remember, kids are often happier when the trip is not completely jam-packed. "Sometimes the best thing for kids is to let them have their free time in a park or playground," Halsted says. Here are suggestions for fun family vacations at three budget points: $500, $1,000 and $5,000. All vacation costs are approximated for a family of four, two adults and two children, although prices vary considerably based on where you start and how you travel. $500 Family Vacation Camping. Halsted is planning a multigenerational trip with 16 relatives to a KOA campground in Eureka Springs, Arkansas, about an eight-hour drive from her home in Iowa. And not all camping requires pitching a tent. In addition to RV spots, KOA and other campgrounds offer cabins, yurts and even tree houses and a caboose for overnight lodging. Not only is it cheaper than staying in a motel, it's a more interesting experience, Rich says, with lots of activities for kids. "At night people aren't holed up," she says. "They're out. They're roasting marshmallows and whatever ... kids get to meet up with other kids. That really enhances the experience." State and national parks. You can visit state and national parks for the day or camp for the night, staying in tents, cabins or lodges. Ohio, for example, has five state parks that are mini-resorts with water sports, pools and lots of activities. They are offering a package with 20 percent off lodging and a $50 daily restaurant credit, Kelleher says. You can also enjoy an affordable vacation at a national park. "For $500, families can have an amazing vacation at any national park," says James Kaiser, who has written guidebooks to several U.S. national parks. He estimates the cost at $60 a day for a family, including the gasoline you'd use to get there. Water park resorts. Resort packages are a great option for families because they include lodging and admission to the water park. Look for these deals at major chain Great Wolf Lodge's parks and at many in Wisconsin Dells, Wisconsin, an area with a number of lodges plus freestanding water parks. If you live near one of those types of attractions, the family can stay a few days. Visiting relatives. Traveling to see relatives who live within driving distance means you don't pay for lodging and can eat at least some meals at home. Thanks to the free room and board, you've got money to explore the attractions in that city. $1,000 Family Vacation Cruise. A family cruise can be surprisingly affordable, especially if you don't have to fly to the port. Summer is the offseason for the Caribbean, so prices will be lower. But you can also get cruises from places besides Florida and Texas, including New York and Boston. Once you've paid your fare, all lodging, meals and activities are covered, and most cruise ships have baby-sitting and activities for the kids. Vacation rental. Want to spend a weekend hanging out at the beach or hiking in the mountains? Pick a destination that's interesting and affordable, and rent a house or apartment. Kelleher was impressed with Daytona Beach, Florida, which not only has pristine beaches but lots of fairly inexpensive things to do. At the Marine Science Center in Ponce Inlet, Florida, for example, admission is $5 for adults and $2 for children. Offseason resort. Resorts in Arizona, Colorado, Florida and other winter destinations offer rock-bottom deals in summer. Yes, it's hot in Arizona, but the resorts have great pools to cool down. While there's no snow in Colorado, there's still great hiking. $5,000 Family Vacation All-inclusive resort in the Caribbean and Mexico. This is the low season in the Caribbean, meaning rates are much more affordable, says Sally Black, a travel agent who publishes a VacationKids.com blog. Some resorts even offer "kids stay free and eat free" packages, as well as free child care. If you don't already have passports, expect to spend more than $100 per person for those. Disney World: Getting the best deal requires planning and knowing when to go, Black says. Prices are better in late summer than early summer, and Disney (DIS) is offering a free dining plan that starts at the end of August. All-inclusive U.S. resort. These include dude ranches and the Club Med properties that cater to families. Kelleher's family has gone for six years to Tyler Place Family Resort in Vermont, where everyone is assigned a bicycle on arrival. There are kids' activities by age group for babies to teens. Discounts are available early and late in the season at many resorts.

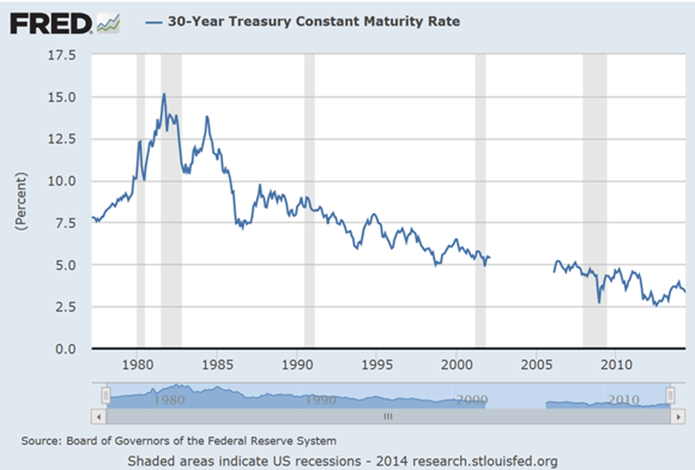

Jim Arbogast/Getty ImagesCamping is one of the more inexpensive summer vacation options for families. With summer comes thoughts of travel: road trips and theme parks and visits to Grandma's house, camping and cruising and hanging out by the pool. The most organized of families, of course, have already made their summer vacation plans. But for those of us who haven't yet decided, or hyper-organized families who are already thinking about next year, we've got some excellent ideas. The good news is you don't have to be rich to enjoy a great family vacation. "A lot of people have in their mind that a family vacation has to cost a lot of money," says Jody Halsted, who shares travel tips at FamilyRambling.com and has been traveling with kids since the first of her two daughters was 3 months old. "It can cost a lot of money, but it doesn't have to." How much a family vacation costs depends on a lot of variables, starting with how long you plan to vacation and whether you will drive or fly. Choice of lodging also makes a big difference, as does what you plan to do and where you plan to eat. And, of course, it depends on where you start your trip. "If people are on a budget, they really should be looking at destinations they could drive to," says Suzanne Rowan Kelleher, the family vacations expert at About.com. A road trip can be a vacation in itself, not just a means to an end. Arm the kids with cameras and let them photograph the World's Largest Ball of Twine or the World's Largest Pistachio Nut, share their photos on social media and create collages when they return home. "A road trip is the perfect family vacation," says Tamela Rich, an author who spends much of her time on road trips. "It's not about going to a destination and forking over money. It's what you do on the way." She suggests letting older kids research and plan what to see and where to eat along the way. She likes the Roadside America (for Apple devices only) and History Here (for both Apple and Android devices) apps for finding unusual sights and historical markers. If your dates are flexible, you can save money. Hotels in large cities are often cheaper over the weekend, but a resort may offer better rates midweek. Extended-stay hotels or vacation rentals let you cook meals. Some chain hotels provide free breakfasts, and a picnic in the park is cheaper than lunch in a restaurant. "If you're eating out three meals a day, that's going to really add up," Kelleher says. Admission fees to theme parks, zoos and attractions can be costly. Check with local tourist offices and websites for destination-city deals and coupon books as well as information on free events. The Entertainment Book, which is significantly discounted now that it's the middle of the year, offers lots of two-for-one coupons for local attractions. Choosing a destination where lots of attractions are free, such was Washington, D.C., also cuts costs. And remember, kids are often happier when the trip is not completely jam-packed. "Sometimes the best thing for kids is to let them have their free time in a park or playground," Halsted says. Here are suggestions for fun family vacations at three budget points: $500, $1,000 and $5,000. All vacation costs are approximated for a family of four, two adults and two children, although prices vary considerably based on where you start and how you travel. $500 Family Vacation Camping. Halsted is planning a multigenerational trip with 16 relatives to a KOA campground in Eureka Springs, Arkansas, about an eight-hour drive from her home in Iowa. And not all camping requires pitching a tent. In addition to RV spots, KOA and other campgrounds offer cabins, yurts and even tree houses and a caboose for overnight lodging. Not only is it cheaper than staying in a motel, it's a more interesting experience, Rich says, with lots of activities for kids. "At night people aren't holed up," she says. "They're out. They're roasting marshmallows and whatever ... kids get to meet up with other kids. That really enhances the experience." State and national parks. You can visit state and national parks for the day or camp for the night, staying in tents, cabins or lodges. Ohio, for example, has five state parks that are mini-resorts with water sports, pools and lots of activities. They are offering a package with 20 percent off lodging and a $50 daily restaurant credit, Kelleher says. You can also enjoy an affordable vacation at a national park. "For $500, families can have an amazing vacation at any national park," says James Kaiser, who has written guidebooks to several U.S. national parks. He estimates the cost at $60 a day for a family, including the gasoline you'd use to get there. Water park resorts. Resort packages are a great option for families because they include lodging and admission to the water park. Look for these deals at major chain Great Wolf Lodge's parks and at many in Wisconsin Dells, Wisconsin, an area with a number of lodges plus freestanding water parks. If you live near one of those types of attractions, the family can stay a few days. Visiting relatives. Traveling to see relatives who live within driving distance means you don't pay for lodging and can eat at least some meals at home. Thanks to the free room and board, you've got money to explore the attractions in that city. $1,000 Family Vacation Cruise. A family cruise can be surprisingly affordable, especially if you don't have to fly to the port. Summer is the offseason for the Caribbean, so prices will be lower. But you can also get cruises from places besides Florida and Texas, including New York and Boston. Once you've paid your fare, all lodging, meals and activities are covered, and most cruise ships have baby-sitting and activities for the kids. Vacation rental. Want to spend a weekend hanging out at the beach or hiking in the mountains? Pick a destination that's interesting and affordable, and rent a house or apartment. Kelleher was impressed with Daytona Beach, Florida, which not only has pristine beaches but lots of fairly inexpensive things to do. At the Marine Science Center in Ponce Inlet, Florida, for example, admission is $5 for adults and $2 for children. Offseason resort. Resorts in Arizona, Colorado, Florida and other winter destinations offer rock-bottom deals in summer. Yes, it's hot in Arizona, but the resorts have great pools to cool down. While there's no snow in Colorado, there's still great hiking. $5,000 Family Vacation All-inclusive resort in the Caribbean and Mexico. This is the low season in the Caribbean, meaning rates are much more affordable, says Sally Black, a travel agent who publishes a VacationKids.com blog. Some resorts even offer "kids stay free and eat free" packages, as well as free child care. If you don't already have passports, expect to spend more than $100 per person for those. Disney World: Getting the best deal requires planning and knowing when to go, Black says. Prices are better in late summer than early summer, and Disney (DIS) is offering a free dining plan that starts at the end of August. All-inclusive U.S. resort. These include dude ranches and the Club Med properties that cater to families. Kelleher's family has gone for six years to Tyler Place Family Resort in Vermont, where everyone is assigned a bicycle on arrival. There are kids' activities by age group for babies to teens. Discounts are available early and late in the season at many resorts. Charles Dharapak/AP Federal Reserve chair Janet Yellen said in earlly May that she expects to keep short-term borrowing rates low for a "considerable time." She's continuing to set a target of seeing healthy employment numbers and inflation around 2 percent before raising short-term rates above their nearly 0 percent levels. While short-term rates will remain low, long-term rates are another story. The Fed is continuing to taper -- to reduce its purchases of U.S. government bonds. The Fed is expected to hold its existing bond portfolio for quite some time. Still, as it stops purchasing new bonds, it takes a very deep-pocketed buyer out of that market. That creates conditions wherein long-term rates will be much more likely to rise. And with the Fed expected to complete its taper this year, long-term rates may rise soon. What This Means for You The chart below shows the history of 30-year Treasury bond interest rates for the past few decades. While nobody is expecting rates to skyrocket to their 15 percent peak, note that before the recent recession and the Fed's long-term bond-buying spree, rates were around 5 percent or so. It's reasonable to anticipate that absent the Fed's incremental buying pressure holding down long-term rates, those rates may revisit that 5 percent level once the Fed stops buying.

Charles Dharapak/AP Federal Reserve chair Janet Yellen said in earlly May that she expects to keep short-term borrowing rates low for a "considerable time." She's continuing to set a target of seeing healthy employment numbers and inflation around 2 percent before raising short-term rates above their nearly 0 percent levels. While short-term rates will remain low, long-term rates are another story. The Fed is continuing to taper -- to reduce its purchases of U.S. government bonds. The Fed is expected to hold its existing bond portfolio for quite some time. Still, as it stops purchasing new bonds, it takes a very deep-pocketed buyer out of that market. That creates conditions wherein long-term rates will be much more likely to rise. And with the Fed expected to complete its taper this year, long-term rates may rise soon. What This Means for You The chart below shows the history of 30-year Treasury bond interest rates for the past few decades. While nobody is expecting rates to skyrocket to their 15 percent peak, note that before the recent recession and the Fed's long-term bond-buying spree, rates were around 5 percent or so. It's reasonable to anticipate that absent the Fed's incremental buying pressure holding down long-term rates, those rates may revisit that 5 percent level once the Fed stops buying.  stlouisfed.orgChart from the Federal Reserve Bank of St. Louis, as of May 17. With 30-year interest rates currently around 3.4 percent, that suggests long-term rates may rise as much as 1.5 percentage points or so over the next few months. In the grand scheme of things, that may not sound like much, but if you own long-term bonds, that kind of rise may be quite painful indeed. The Rate and Price Seesaw

stlouisfed.orgChart from the Federal Reserve Bank of St. Louis, as of May 17. With 30-year interest rates currently around 3.4 percent, that suggests long-term rates may rise as much as 1.5 percentage points or so over the next few months. In the grand scheme of things, that may not sound like much, but if you own long-term bonds, that kind of rise may be quite painful indeed. The Rate and Price Seesaw AlamyCitizens Bank ranks the No. 1 financial institution among baby boomers. Each stage of life brings with it a unique set of challenges to overcome and benchmarks to hit -- and this is especially true when it comes to banking. Although financial institutions target millennials heavily, baby boomers (Americans born between 1946 and 1964) are still the most represented generation among today's banking customers. A December Gallup poll revealed that 89 percent of baby boomers have at least one checking, savings or money market account. With more than 75 million baby boomers in the United States, there's a greater demand for financial institutions that cater to the boomer lifestyle. 3 Things Baby Boomers Need Most From Banks The youngest baby boomers have reached seniority in the labor force, while the oldest members of this generation have entered retirement. Both ends of the spectrum have vastly different circumstances when it comes to income, but no matter their age, boomers have three main banking needs. 1. Customer Service. Customer service comes in many forms, whether from an in-person associate at a brick-and-mortar branch or an attendant at a small kiosk in a local grocery store. Boomers have grown up with institutions that rely on real-life, person-to-person transactions that allow them to talk through terms and conditions and have questions addressed. Physical bank branches are necessary in order to fulfill this service expectation. As more financial institutions have turned to online and mobile banking, some baby boomers who are slow to adapt to banking technology have been isolated as a result. 2. Retirement Planning. With the average life span in the U.S. expanding each year, and so many baby boomers on the road to retirement, the need for retirement planning resources becomes more and more pressing for many banking customers. "In my experience, the most stressful situation that baby boomers encounter is the fear of running out of money during retirement," says Jonathan Duong, a certified financial planner and president of the wealth management firm Wealth Engineers. "Although most baby boomers have several sources of retirement income, ranging from Social Security and pensions to their own retirement savings, many of them lack a true financial plan to help them understand how much they can spend in retirement," Duong says. "Not having a plan often leads to one of two negative outcomes: 1. The retiree lives a substandard retirement -- below what his or her income and savings can actually support -- due to the fear of running out of money. Or 2. The retiree overspends and then runs into the significant risk of outliving their savings." In addition to staying on top of income during retirement, boomers need the assistance of a financial adviser to understand the kinds of expenses that could become more costly over time, like health care. This awareness can mean the difference between boomers being financially unprepared in the next stage of their life or living a comfortable lifestyle after leaving the workforce. 3. Convenience. While baby boomers are seen as traditionalists when compared to Generation Y (those in their 20s and early 30s), the two generations have something in common -- they both want convenience. A 2013 Gallup poll found that 71 percent of boomers use online banking services at least weekly -- right in line with Generation X (70 percent) and Generation Y (72 percent). Millennials might be quick to adopt new technology, like mobile banking, but there are more tech-savvy boomers surfing the Web for their banking needs than previously thought. Efficiency and convenience play a major role in baby boomer satisfaction, which makes banking services like online banking and electronic bill pay appealing. 10 Best Financial Institutions for Baby Boomers Not all financial institutions are focused on the welfare of transitioning boomers, but there are a number of banks that still offer comprehensive services to this substantial population of customers. Based on specialty retirement and financial planning services, products and resources, accessibility and customer service, GOBankingRates identified the 10 best banks for baby boomers in 2014: 1. Citizens Bank -- Providence, Rhode Island 2. Frost Bank -- San Antonio, Texas (CFR) 3. Arvest Bank -- Lowell, Arkansas 4. BB&T -- Winston-Salem, North Carolina (BBT) 5. TD Bank -- Cherry Hill, New Jersey (TD) 6. Bangor Savings Bank -- Bangor, Maine 7. Huntington Bank -- Columbus, Ohio (HBAN) 8. Wells Fargo -- San Francisco (WFC) 9. USAA -- San Antonio, Texas 10. American Savings Bank -- Honolulu, Hawaii .

AlamyCitizens Bank ranks the No. 1 financial institution among baby boomers. Each stage of life brings with it a unique set of challenges to overcome and benchmarks to hit -- and this is especially true when it comes to banking. Although financial institutions target millennials heavily, baby boomers (Americans born between 1946 and 1964) are still the most represented generation among today's banking customers. A December Gallup poll revealed that 89 percent of baby boomers have at least one checking, savings or money market account. With more than 75 million baby boomers in the United States, there's a greater demand for financial institutions that cater to the boomer lifestyle. 3 Things Baby Boomers Need Most From Banks The youngest baby boomers have reached seniority in the labor force, while the oldest members of this generation have entered retirement. Both ends of the spectrum have vastly different circumstances when it comes to income, but no matter their age, boomers have three main banking needs. 1. Customer Service. Customer service comes in many forms, whether from an in-person associate at a brick-and-mortar branch or an attendant at a small kiosk in a local grocery store. Boomers have grown up with institutions that rely on real-life, person-to-person transactions that allow them to talk through terms and conditions and have questions addressed. Physical bank branches are necessary in order to fulfill this service expectation. As more financial institutions have turned to online and mobile banking, some baby boomers who are slow to adapt to banking technology have been isolated as a result. 2. Retirement Planning. With the average life span in the U.S. expanding each year, and so many baby boomers on the road to retirement, the need for retirement planning resources becomes more and more pressing for many banking customers. "In my experience, the most stressful situation that baby boomers encounter is the fear of running out of money during retirement," says Jonathan Duong, a certified financial planner and president of the wealth management firm Wealth Engineers. "Although most baby boomers have several sources of retirement income, ranging from Social Security and pensions to their own retirement savings, many of them lack a true financial plan to help them understand how much they can spend in retirement," Duong says. "Not having a plan often leads to one of two negative outcomes: 1. The retiree lives a substandard retirement -- below what his or her income and savings can actually support -- due to the fear of running out of money. Or 2. The retiree overspends and then runs into the significant risk of outliving their savings." In addition to staying on top of income during retirement, boomers need the assistance of a financial adviser to understand the kinds of expenses that could become more costly over time, like health care. This awareness can mean the difference between boomers being financially unprepared in the next stage of their life or living a comfortable lifestyle after leaving the workforce. 3. Convenience. While baby boomers are seen as traditionalists when compared to Generation Y (those in their 20s and early 30s), the two generations have something in common -- they both want convenience. A 2013 Gallup poll found that 71 percent of boomers use online banking services at least weekly -- right in line with Generation X (70 percent) and Generation Y (72 percent). Millennials might be quick to adopt new technology, like mobile banking, but there are more tech-savvy boomers surfing the Web for their banking needs than previously thought. Efficiency and convenience play a major role in baby boomer satisfaction, which makes banking services like online banking and electronic bill pay appealing. 10 Best Financial Institutions for Baby Boomers Not all financial institutions are focused on the welfare of transitioning boomers, but there are a number of banks that still offer comprehensive services to this substantial population of customers. Based on specialty retirement and financial planning services, products and resources, accessibility and customer service, GOBankingRates identified the 10 best banks for baby boomers in 2014: 1. Citizens Bank -- Providence, Rhode Island 2. Frost Bank -- San Antonio, Texas (CFR) 3. Arvest Bank -- Lowell, Arkansas 4. BB&T -- Winston-Salem, North Carolina (BBT) 5. TD Bank -- Cherry Hill, New Jersey (TD) 6. Bangor Savings Bank -- Bangor, Maine 7. Huntington Bank -- Columbus, Ohio (HBAN) 8. Wells Fargo -- San Francisco (WFC) 9. USAA -- San Antonio, Texas 10. American Savings Bank -- Honolulu, Hawaii .

MORE GURUFOCUS LINKS

MORE GURUFOCUS LINKS  58.02 (1y: +121%) $(function(){var seriesOptions=[],yAxisOptions=[],name='FB',display='';Highcharts.setOptions({global:{useUTC:true}});var d=new Date();$current_day=d.getDay();if($current_day==5||$current_day==0||$current_day==6){day=4;}else{day=7;} seriesOptions[0]={id:name,animation:false,color:'#4572A7',lineWidth:1,name:name.toUpperCase()+' stock price',threshold:null,data:[[1368766800000,26.25],[1369026000000,25.759],[1369112400000,25.66],[1369198800000,25.159],[1369285200000,25.06],[1369371600000,24.313],[1369717200000,24.1],[1369803600000,23.32],[1369890000000,24.55],[1369976400000,24.348],[1370235600000,23.848],[1370322000000,23.52],[1370408400000,22.899],[1370494800000,22.97],[1370581200000,23.291],[1370840400000,24.33],[1370926800000,24.03],[1371013200000,23.77],[1371099600000,23.73],[1371186000000,23.63],[1371445200000,24.022],[1371531600000,24.21],[1371618000000,24.309],[1371704400000,23.9],[1371790800000,24.53],[1372050000000,23.935],[1372136400000,24.25],[1372222800000,24.16],[1372309200000,24.66],[1372395600000,24.88],[1372654800000,24.81],[1372741200000,24.41],[1372827600000,24.52],[1373000400000,24.37],[1373259600000,24.71],[1373346000000,25.48],[1373432400000,25.8],[1373518800000,25.81],[1373605200000,25.91],[1373864400000,26.28],[1373950800000,26.32],[1374037200000,26.65],[1374123600000,26.18],[1374210000000,25.881],[1374469200000,26.045],[1374555600000,26.13],[1374642000000,26.51],[1374728400000,34.359],[1374814800000,34.01],[1375074000000,35.43],[1375160400000,37.627],[1375246800000,36.8],[1375333200000,37.489],[1375419600000,38.05],[1375678800000,39.189],[1375765200000,38.55],[1375851600000,38.87],[1375938000000,38.54],[1376024400000,38.5],[1376283600000,38.22],[1376370000000,37.019],[1376456400000,36.65],[1376542800000,36.56],[1376629200000,37.08],[1376888400000,37.81],[1376974800000,38.41],[1377061200000,38.32],[1377147600000,38.55],[1377234000000,40.55],[1377493200000,41.34],[1377579600000,39.64],[1377666000000,40.548],[1377752400000,41.28],[1377838800000,41.294],[1378184400000,41.87],[1378270800000,41.78],[1378357200000,42.66],[1378443600000,43.95],[1378702800000,44.04],[1378789200000,43.6],[1378875600000,45.04],[1378962000000,44.75],[1379048400000,44.31],[1379307600000,42.51],[1379394000000,45.07],[1379480400000,45.23],[137! 9566800000,45.98],[1379653200000,47.49],[1379912400000,47.19],[1379998800000,48.45],[1380085200000,49.46],[1380171600000,50.39],[1380258000000,51.24],[1380517200000,50.23],[1380603600000,50.42],[1380690000000,50.28],[1380776400000,49.183],[1380862800000,51.04],[1381122000000,50.515],[1381208400000,47.14],[1381294800000,46.77],[1381381200000,49.05],[1381467600000,49.11],[1381726800000,49.51],[1381813200000,49.5],[1381899600000,51.135],[1381986000000,52.21],[1382072400000,54.22],[1382331600000,53.85],[1382418000000,52.675],[1382504400000,51.9],[1382590800000,52.445],[1382677200000,51.95],[1382936400000,50.229],[1383022800000,49.395],[1383109200000,49.01],[1383195600000,50.205],[1383282000000,49.75],[1383544800000,48.22],[1383631200000,50.105],[1383717600000,49.12],[1383804000000,47.56],[1383890400000,47.53],[1384149600000,46.2],[1384236000000,46.605],[1384322400000,48.71],[1384408800000,48.99],[1384495200000,49.01],[1384754400000,45.83],[1384840800000,46.36],[1384927200000,46.43],[1385013600000,46.7],[1385100000000,46.23],[1385359200000,44.82],[1385445600000,45.89],[1385532000000,46.49],[1385704800000,47.01],[1385964000000,47.06],[1386050400000,46.73],[1386136800000,48.62],[1386223200000,48.34],[1386309600000,47.94],[1386568800000,48.84],[1386655200000,50.245],[138674

58.02 (1y: +121%) $(function(){var seriesOptions=[],yAxisOptions=[],name='FB',display='';Highcharts.setOptions({global:{useUTC:true}});var d=new Date();$current_day=d.getDay();if($current_day==5||$current_day==0||$current_day==6){day=4;}else{day=7;} seriesOptions[0]={id:name,animation:false,color:'#4572A7',lineWidth:1,name:name.toUpperCase()+' stock price',threshold:null,data:[[1368766800000,26.25],[1369026000000,25.759],[1369112400000,25.66],[1369198800000,25.159],[1369285200000,25.06],[1369371600000,24.313],[1369717200000,24.1],[1369803600000,23.32],[1369890000000,24.55],[1369976400000,24.348],[1370235600000,23.848],[1370322000000,23.52],[1370408400000,22.899],[1370494800000,22.97],[1370581200000,23.291],[1370840400000,24.33],[1370926800000,24.03],[1371013200000,23.77],[1371099600000,23.73],[1371186000000,23.63],[1371445200000,24.022],[1371531600000,24.21],[1371618000000,24.309],[1371704400000,23.9],[1371790800000,24.53],[1372050000000,23.935],[1372136400000,24.25],[1372222800000,24.16],[1372309200000,24.66],[1372395600000,24.88],[1372654800000,24.81],[1372741200000,24.41],[1372827600000,24.52],[1373000400000,24.37],[1373259600000,24.71],[1373346000000,25.48],[1373432400000,25.8],[1373518800000,25.81],[1373605200000,25.91],[1373864400000,26.28],[1373950800000,26.32],[1374037200000,26.65],[1374123600000,26.18],[1374210000000,25.881],[1374469200000,26.045],[1374555600000,26.13],[1374642000000,26.51],[1374728400000,34.359],[1374814800000,34.01],[1375074000000,35.43],[1375160400000,37.627],[1375246800000,36.8],[1375333200000,37.489],[1375419600000,38.05],[1375678800000,39.189],[1375765200000,38.55],[1375851600000,38.87],[1375938000000,38.54],[1376024400000,38.5],[1376283600000,38.22],[1376370000000,37.019],[1376456400000,36.65],[1376542800000,36.56],[1376629200000,37.08],[1376888400000,37.81],[1376974800000,38.41],[1377061200000,38.32],[1377147600000,38.55],[1377234000000,40.55],[1377493200000,41.34],[1377579600000,39.64],[1377666000000,40.548],[1377752400000,41.28],[1377838800000,41.294],[1378184400000,41.87],[1378270800000,41.78],[1378357200000,42.66],[1378443600000,43.95],[1378702800000,44.04],[1378789200000,43.6],[1378875600000,45.04],[1378962000000,44.75],[1379048400000,44.31],[1379307600000,42.51],[1379394000000,45.07],[1379480400000,45.23],[137! 9566800000,45.98],[1379653200000,47.49],[1379912400000,47.19],[1379998800000,48.45],[1380085200000,49.46],[1380171600000,50.39],[1380258000000,51.24],[1380517200000,50.23],[1380603600000,50.42],[1380690000000,50.28],[1380776400000,49.183],[1380862800000,51.04],[1381122000000,50.515],[1381208400000,47.14],[1381294800000,46.77],[1381381200000,49.05],[1381467600000,49.11],[1381726800000,49.51],[1381813200000,49.5],[1381899600000,51.135],[1381986000000,52.21],[1382072400000,54.22],[1382331600000,53.85],[1382418000000,52.675],[1382504400000,51.9],[1382590800000,52.445],[1382677200000,51.95],[1382936400000,50.229],[1383022800000,49.395],[1383109200000,49.01],[1383195600000,50.205],[1383282000000,49.75],[1383544800000,48.22],[1383631200000,50.105],[1383717600000,49.12],[1383804000000,47.56],[1383890400000,47.53],[1384149600000,46.2],[1384236000000,46.605],[1384322400000,48.71],[1384408800000,48.99],[1384495200000,49.01],[1384754400000,45.83],[1384840800000,46.36],[1384927200000,46.43],[1385013600000,46.7],[1385100000000,46.23],[1385359200000,44.82],[1385445600000,45.89],[1385532000000,46.49],[1385704800000,47.01],[1385964000000,47.06],[1386050400000,46.73],[1386136800000,48.62],[1386223200000,48.34],[1386309600000,47.94],[1386568800000,48.84],[1386655200000,50.245],[138674

Reuters

Reuters  Marissa Mayer (Photo credit: Wikipedia)

Marissa Mayer (Photo credit: Wikipedia)

Not all long/short strategies (or managers) are created equal, something about which Adam Patti doesn’t mince words.

Not all long/short strategies (or managers) are created equal, something about which Adam Patti doesn’t mince words.