JPMorgan Chase (NYSE: JPM ) stock closed the trading week up 1.8% -- a surprisingly weak performance considering the bank's strong second-quarter results, but maybe not so surprising considering what else went down in the banking sector over the past five days. Regardless, investors don't realize how good they have it.

The good, the bad, and the confusing

First, the good news, or what should be taken as good news. JPMorgan reported second-quarter total net revenue of $25.2 billion and net income of $6.5 billion, versus $22.2 billion and $5.0 billion for the second quarter of 2012, respectively. Earnings per share were $1.60, versus $1.21 for the same period last year. �

And now the bad news, or what is in all actuality good news.

Earlier this week, the Federal Reserve, the Office of the Comptroller of the Currency, and the Federal Deposit Insurance Corporation proposed new rules for America's financial system: All banks would be required to double their capital reserves, and the eight-biggest bank-holding companies would be required to have leverage ratios of 5%.

Top Insurance Companies To Own For 2014: Berkshire Hathaway Inc (BRKB.N)

Berkshire Hathaway Inc. (Berkshire) is a holding company owning subsidiaries engaged in a number of diverse business activities. The Company is engaged in insurance businesses conducted on both a primary basis and a reinsurance basis. Berkshire also owns and operates a number of other businesses engaged in a variety of activities. On December 30, 2011, Medical Protective Corporation (MedPro) completed the acquisition of 100% of the Princeton Insurance Company, a professional liability insurer for healthcare providers based in Princeton, New Jersey. During the year ended December 31, 2011, Acme Building Brands (Acme) acquired the assets of Jenkins Brick Company, the brick manufacturer in Alabama. In September 2011, Berkshire acquired The Lubrizol Corporation (Lubrizol). In June 2011, the Company acquired Wesco Financial Corporation. In June 2012, Media General, Inc. sold 63 daily and weekly newspapers to World Media Enterprises, Inc., a subsidiary of Berkshire. In July 2 012, Berkshire�� The Lubrizol Corporation acquired Lipotec SA.

Insurance and Reinsurance Businesses

Berkshire�� insurance and reinsurance business activities are conducted through numerous domestic and foreign-based insurance entities. Berkshire�� insurance businesses provide insurance and reinsurance of property and casualty risks world-wide and also reinsure life, accident and health risks world-wide. Berkshire�� insurance underwriting operations are consisted of the sub-groups, including GEICO and its subsidiaries, General Re and its subsidiaries, Berkshire Hathaway Reinsurance Group and Berkshire Hathaway Primary Group. GEICO insurance subsidiaries include Government Employees Insurance Company, GEICO General Insurance Company, GEICO Indemnity Company and GEICO Casualty Company. These companies primarily offers private passenger automobile insurance to individuals in all 50 states and the District of Columbia. In addition, GEICO insures motorcycles, all-terrain vehicles, recreational vehicles a! n! d small commercial fleets and acts as an agent for other insurers who offer homeowners, boat and life insurance to individuals. GEICO markets its policies primarily through direct response methods in which applications for insurance are submitted directly to the companies through the Internet or by telephone.

General Re Corporation (General Re) is the holding company of General Reinsurance Corporation (GRC) and its subsidiaries and affiliates. GRC�� subsidiaries include General Reinsurance AG, a international reinsurer based in Germany. General Re subsidiaries conduct business activities globally in 51 cities and provide insurance and reinsurance coverages throughout the world. General Re provides property/casualty insurance and reinsurance, life/health reinsurance and other reinsurance intermediary and risk management, underwriting management and investment management services.

Property/Casualty Reinsurance

General Re�� property/c asualty reinsurance business in North America is conducted through GRC. Property/casualty operations in North America are also conducted through 16 branch offices in the United States and Canada. Reinsurance activities are marketed directly to clients without involving a broker or intermediary. General Re�� property/casualty business in North America also includes specialty insurers (primarily the General Star and Genesis companies domiciled in Connecticut and Ohio). These specialty insurers underwrite primarily liability and workers��compensation coverages on an excess and surplus basis and excess insurance for self-insured programs. General Re�� international property/casualty reinsurance business operations are conducted through internationally-based subsidiaries on a direct basis (through General Reinsurance AG, as well as several other General Re subsidiaries in 25 countries) and through brokers (primarily through Faraday, which owns the managing agent of Syndicat e 435 at Lloyd�� of London and provides capacity and ! parti! ci! pates i! n 100% of the results of Syndicate 435).

Life/Health Reinsurance

General Re�� North American and international life, health, long-term care and disability reinsurance coverages are written on an individual and group basis. Most of this business is written on a proportional treaty basis, with the exception of the United States group health and disability business which is predominately written on an excess treaty basis. Lesser amounts of life and disability business are written on a facultative basis. The life/health business is marketed on a direct basis. The Berkshire Hathaway Reinsurance Group (BHRG) operates from offices located in Stamford, Connecticut. Business activities are conducted through a group of subsidiary companies, led by National Indemnity Company (NICO) and Columbia Insurance Company (Columbia). BHRG provides principally excess and quota-share reinsurance to other property and casualty insurers and reinsurers. BHRG�� underwrit ing activities also include life reinsurance and life annuity business written through Berkshire Hathaway Life Insurance Company of Nebraska and financial guaranty insurance written through Berkshire Hathaway Assurance Corporation.

BHRG writes catastrophe excess-of-loss treaty reinsurance contracts. BHRG also writes individual policies for primarily large or otherwise unusual discrete risks on both an excess direct and facultative reinsurance basis, referred to as individual risk, which includes policies covering terrorism, natural catastrophe and aviation risks. A catastrophe excess policy provides protection to the counterparty from the accumulation of primarily property losses arising from a single loss event or series of related events. Catastrophe and individual risk policies may provide amounts of indemnification per contract and a single loss event may produce losses under a number of contracts. BHRG also underwrites traditional non-catastrophe insurance and reinsurance coverages, referred to as multi-li! ne proper! t! y/casualt! y business.

The Berkshire Hathaway Primary Group is a collection of primary insurance operations that provide a variety of insurance coverages to insureds located principally in the United States. NICO and certain affiliates underwrite motor vehicle and general liability insurance to commercial enterprises on both an admitted and excess and surplus basis. This business is written nationwide primarily through insurance agents and brokers and is based in Omaha, Nebraska. U.S. Investment Corporation (USIC), through its three subsidiaries led by United States Liability Insurance Company, is a specialty insurer that underwrites commercial, professional and personal lines of insurance on an admitted and excess and surplus basis. Policies are marketed in all 50 states and the District of Columbia through wholesale and retail insurance agents. USIC companies underwrite and market 109 distinct specialty property and casualty insurance products. Medical Protective Corpora tion (MedPro) is based in Fort Wayne, Indiana. Through its subsidiary, the Medical Protective Company, MedPro is engaged in primary medical professional liability coverage and risk solutions to physicians, dentists, other healthcare providers and healthcare facilities.

Railroad Business

Through BNSF Railway, BNSF operates a railroad network in North America with approximately 32,000 route miles of track (excluding multiple main tracks, yard tracks and sidings) in 28 states and two Canadian provinces as of December 31, 2011. BNSF owns approximately 23,000 route miles, including easements, and operates on approximately 9,000 route miles of trackage rights that permit BNSF to operate its trains with its crews over other railroads��tracks. As of December 31, 2011, the total BNSF Railway system, including single and multiple main tracks, yard tracks and sidings, consisted of approximately 50,000 operated miles of track, all of which are owned by or he ld under easement by BNSF except for approxi! mately 10! ,000 ro! ute miles! operated under trackage rights.

BNSF is based in Fort Worth, Texas, and through BNSF Railway Company operates railroad systems in North America. In serving the Midwest, Pacific Northwest, Western, Southwestern and Southeastern regions and ports of the country, BNSF transports a range of products and commodities derived from manufacturing, agricultural and natural resource industries. In serving the Midwest, Pacific Northwest, Western, Southwestern and Southeastern regions and ports of the country, BNSF transports a range of products and commodities derived from manufacturing, agricultural and natural resource industries. Over half of the freight revenues of BNSF are covered by contractual agreements of varying durations. BNSF�� primary routes, including trackage rights, allow it to access cities and ports in the western and southern United States as well as parts of Canada and Mexico. In addition to cities and ports, BNSF efficiently serves many smaller mar kets by working closely with approximately 200 shortline partners. BNSF has also entered into marketing agreements with other rail carriers, expanding the marketing reach for each railroad and their customers.

Utilities and Energy Businesses

MidAmerican�� businesses are managed as separate operating units. MidAmerican�� domestic regulated energy interests are comprised of two regulated utility companies serving more than three million retail customers and two interstate natural gas pipeline companies with approximately 16,600 miles of pipeline and a design capacity of approximately 7.7 billion cubic feet of natural gas per day. Its United Kingdom electricity distribution subsidiaries serve about 3.9 million electricity end-users. In addition, MidAmerican�� interests include a diversified portfolio of domestic independent power projects, a hydroelectric facility in the Philippines and residential real estate brokerage firm in the United States .

PacifiCorp is a regulate! d electri! c utility co! mpany hea! dquartered in Oregon, serving regulated retail electric customers in portions of Utah, Oregon, Wyoming, Washington, Idaho and California. The combined service territory�� diverse regional economy ranges from rural, agricultural and mining areas to urban, manufacturing and government service centers. As a vertically integrated electric utility, PacifiCorp owns approximately 10,600 net megawatts of generation capacity. MidAmerican Energy Company (MEC) is a regulated electric and natural gas utility company headquartered in Iowa, serving regulated retail electric and natural gas customers primarily in Iowa and also in portions of Illinois, South Dakota and Nebraska. MEC has a diverse customer base consisting of residential, agricultural and a variety of commercial and industrial customer groups. In addition to retail sales and natural gas transportation, MEC sells regulated electricity to markets operated by regional transmission organizations and regulated electricity and na tural gas to other utilities and market participants on a wholesale basis and sells non-regulated electricity and natural gas services in deregulated markets. As a vertically integrated electric and gas utility, MEC owns approximately 7,000 net megawatts of generation capacity.

The natural gas pipelines consist of Northern Natural Gas Company (Northern Natural) and Kern River Gas Transmission Company (Kern River). Northern Natural is based in Nebraska and owns interstate natural gas pipeline systems in the United States reaching from southern Texas to Michigan�� Upper Peninsula. Northern Natural�� pipeline system consists of approximately 14,900 miles of natural gas pipelines. Northern Natural has access to supplies from mid-continent basin and provides transportation services to utilities and numerous other customers. Northern Natural also operates three underground natural gas storage facilities and two liquefied natural gas storage peaking units.

Kern River is based in Utah ! and owns ! an interstate natu! ral gas p! ipeline system that consists of approximately 1,700 miles and extends from the supply areas in the Rocky Mountains to consuming markets in Utah, Nevada and California. Kern River transports natural gas for electric utilities and natural gas distribution utilities, oil and natural gas companies or affiliates of such companies, electricity generating companies, energy marketing and trading companies, and financial institutions. The United Kingdom utilities consist of Northern Powergrid (Northeast) Limited (Northern Powergrid (Northeast)) and Northern Powergrid (Yorkshire) plc (Northern Powergrid (Yorkshire)), which own a substantial United Kingdom electricity distribution network that delivers electricity to end-users in northeast England in an area covering approximately 10,000 square miles. The distribution companies primarily charge supply companies regulated tariffs for the use of electrical infrastructure. MidAmerican also owns HomeServices of America, Inc. (HomeServices) , a full-service residential real estate brokerage firm in the United States. HomeServices also offers integrated real estate services, including mortgage originations through a joint venture, title and closing services, property and casualty insurance, home warranties, relocation services and other home-related services. It operates under 22 residential real estate brand names with over 14,000 sales associates and in nearly 300 brokerage offices in 20 states.

Manufacturing, Service and Retailing Businesses

Berkshire�� numerous and diverse manufacturing, service and retailing businesses. Marmon consists of approximately 140 manufacturing and service businesses that operate independently within eleven diverse, stand-alone business sectors. These sectors are Building Wire, Crane Services, Distribution Services, Engineered Wire and Cable, Flow Products, Food Service Equipment, Highway Technologies, Industrial Products, Retail Store Fixtures, Transpo rtation Services and Engine! ered Prod! ucts and Water Treatment! .

Building Wire, providing copper electrical building wire for residential, commercial and industrial construction. Crane Services provides the leasing and operation of mobile cranes primarily to the energy, mining and petrochemical markets. Distribution Services, supplying specialty metal pipe and tubing, bar and sheet products to markets including construction, industrial, aerospace and many others. Engineered Wire & Cable, providing electrical and electronic wire and cable for energy related markets and other industries. Flow Products is producing copper tube for the plumbing, heating, ventilation, and air conditioning (HVAC), refrigeration, and industrial markets. Food Service Equipment is supplying commercial food preparation equipment for restaurants and shopping carts for retail stores. Highway Technologies, primarily serving the heavy-duty highway transportation industry with trailers, fifth wheel coupling devices and undercarriage products such as brake parts an d suspension systems, and also serving the light vehicle aftermarket with clutches and related products.

Industrial Products, consisting of metal fasteners for the building, furniture, cabinetry, industrial and other markets, gloves for industrial markets, portable lighting equipment for mining and safety markets, overhead electrification equipment for mass transit systems, custom-machined brass, aluminum and copper forgings for the construction, valve and other industries, brass fittings and valves for commercial and industrial applications, and drawn aluminum tubing and extruded aluminum shapes for the construction, automotive, appliance, medical and other markets . Retail Store Fixtures, providing shelving and other merchandising displays and related services for retail stores worldwide. Transportation Services & Engineered Products, including manufacturing, leasing and maintenance of railroad tank cars, leasing of intermodal tank containers, in-plant rail s ervices, manufacturin! g of bi-m! odal railcar movers, wheel, ax! le and ge! ar sets for light rail transit and gear products for locomotives, manufacturing of steel tank heads, and services, equipment and technology for processing and distributing sulfur. Water Treatment, equipment including residential water softening, purification and refrigeration filtration systems, treatment systems for industrial markets including power generation, oil and gas, chemical, and pulp and paper, gear drives for irrigation systems and cooling towers, and air-cooled heat exchangers. Marmon operates approximately 300 manufacturing, distribution and service facilities that are primarily located in North America, Europe and China, and employs more than 16,000 people worldwide.

McLane Company, Inc. (McLane) provides wholesale distribution and logistics services in all 50 states and internationally in Brazil to customers that include discount retailers, convenience stores, wholesale clubs, quick service restaurants, drug stores and military bases. Operations are divided into five business units: grocery distribution, foodservice distribution, beverage distribution, international logistics and software development. McLane�� foodservice distribution unit, based in Carrollton, Texas, focuses on serving the quick service restaurant industry. Operations are conducted through 18 facilities in 16 states. The foodservice distribution unit services more than 20,000 chain restaurants nationwide.

Other Manufacturing, Other Service and Retailing Businesses

Berkshire�� apparel manufacturing businesses include manufacturers of a variety of clothing and footwear. Businesses engaged in the manufacture and distribution of clothing products include Fruit of the Loom, Inc. (Fruit), Russell Brands, LLC (Russell), Vanity Fair Brands, LP (VFB), Garan and Fechheimer Brothers. Berkshire�� footwear businesses include H.H. Brown Shoe Group, Justin Brands and Brooks Athletic. Fruit, Russell and VFB (together FOL) is prima rily a verticall! y integra! ted manufacturer and distributor of! basic ap! parel, underwear and athletic apparel and products. Products, under the Fruit of the Loomand JERZEES labels are primarily sold in the mass merchandise and wholesale markets. In the VFB product line, Vassarette, Bestformand Curvationare sold in the mass merchandise market, while Vanity Fairand Lily of Franceproducts are sold in the mid-tier chains and department stores. FOL also markets and sells athletic uniforms, apparel, sports equipment and balls to team dealers; college licensed tee shirts and fleecewear to college bookstores and mid-tier merchants; and athletic apparel, sports equipment and balls to sporting goods retailers under the Russell Athleticand Spaldingbrands. Additionally, Spaldingmarkets and sells balls in the mass merchandise market and dollar store channel. During the year ended December, 31, 2011, approximately 30% of FOL�� sales were to Wal-Mart. FOL generally performs its own spinning, knitting, cloth finishing, cutting, sewing and packaging.

Garan designs, manufactures, imports and sells apparel primarily for children, including boys, girls, toddlers and infants. Products are sold under its own trademark Garanimalsand private labels of its customers. Garan also licenses its registered trademark Garanimalsto independent third parties. Garan conducts its business through operating subsidiaries located in the United States, Central America and Asia. Substantially all of Garan�� products are sold through its distribution centers in the United States to national chain stores, department stores and specialty stores. In 2011, over 90% of Garan�� sales were to Wal-Mart. Fechheimer Brothers manufactures, distributes and sells uniforms, principally for the public service and safety markets, including police, fire, postal and military markets. Fechheimer Brothers is based in Cincinnati, Ohio.

Justin Brands and H.H. Brown Shoe Group manufacture and distribute work, rugged outdoor and casual shoes and western-styl! e footwea! r under a number of brand names, includ! ing Justi! n, Tony Lama, Nocona, Chippewas, Born, Sofft, Carolina, Double-H Boots, Corcoran, Matterhornand Kork-Ease. Brooks Athletic markets and sells running footwear to specialty retailers under Brooksbrand. In 2011, Brooksachieved #1 market share in footwear with specialty retailers. A volume of the shoes sold by Berkshire�� shoe businesses are manufactured or purchased from sources outside the United States. Products are principally sold in the United States through a variety of channels including department stores, footwear chains, specialty stores, catalogs and the Internet, as well as through Company-owned retail stores.

Acme manufactures and distributes clay bricks (Acme Brickand Jenkins Brick), concrete block (Featherlite) and cut limestone (Texas Quarries). In addition, Acme distributes a number of other building products of other manufacturers, including glass block, floor and wall tile and other masonry products. Acme also sells ceramic floor and wall tile, as well as marble, granite and other stones through its subsidiary, American Tile and Stone. Products are sold primarily in the South Central and South Eastern United States through Company-operated sales offices. Acme distributes products primarily to homebuilders and masonry and general contractors.

Benjamin Moore & Co. (Benjamin Moore) is a formulator, manufacturer and retailer of a range of architectural coatings, available principally in the United States and Canada. Products include water-thinnable and solvent-thinnable general purpose coatings (paints, stains and clear finishes) for use by the general public, contractors and industrial and commercial users. Products are marketed under various registered brand names, including Regal, Superspec, Moorcraft, Moorgard, Aura, Nattura, ben, Coronado Paint, Insl-xand Lenmar.

Benjamin Moore and its manufacturing subsidiaries rely primarily on an independent dealer network for the distribution of it s produ! cts. Its ! distribution network includes approximately ! 100 Compa! ny-owned stores as well as over 4,500 third party retailers representing over 10,300 storefronts in the United States and Canada. Benjamin Moore�� Company-owned stores represent several multiple-outlet and stand-alone retailers in various parts of the United States and Canada serving primarily contractors and general consumers. The independent retailer channel offers an array of products including Benjamin Mooreand Insl-xbrands and other competitor coatings, wallcoverings, window treatments and sundries Benjamin Moore also has three color stations located in regional malls that serve as brand marketing tools. In addition to the independent retailer channel, Benjamin Moore has recently begun to sell direct to the consumer through e-commerce sites and its customer care program, which includes national accounts and government agencies.

Johns Manville (JM) is a manufacturer and marketer of products for building insulation, mechanical insulation, commercial roofi ng and roof insulation, as well as fibers and nonwovens for commercial, industrial and residential applications. JM serves markets that include aerospace, automotive and transportation, air handling, appliance, HVAC, pipe and equipment filtration, waterproofing, building, flooring, interiors and wind energy. Fiber glass is the basic material in a majority of JM�� products, although JM also manufactures a portion of its products with other materials to satisfy the broader needs of its customers. JM regards its patents and licenses as valuable, however it does not consider any of its businesses to be materially dependent on any single patent or license. JM is headquartered in Denver, Colorado, and operates 40 manufacturing facilities in North America, Europe and China and conducts research and development at several other facilities. JM sells its products through a variety of channels, including contractors, distributors, retailers, manufacturers and fabricators.

MiTek is! a provider of engineered connector products, eng! ineering ! software and services and computer-driven manufacturing machinery to the truss fabrication segment of the building components industry. Primary customers are truss fabricators who manufacture pre-fabricated roof and floor trusses and wall panels for the residential building market, as well as the light commercial and institutional construction industry. MiTek also participates in the light gauge steel framing market under the Ultra-Spanname, manufactures and markets assembly line machinery used by the lead acid battery industry, manufactures and markets a line of masonry connector products and manufactures and markets air handling systems used in commercial building. MiTek operates on six continents with sales into approximately 90 countries. MiTek has 34 manufacturing facilities located in eleven countries and 45 sales/engineering offices located in 17 countries. The Shaw Industries Group, Inc. (Shaw) is a carpet manufacturer based on both revenue and volume o f production. Shaw designs and manufactures over 3,000 styles of tufted carpet, tufted and woven rugs, laminate and wood flooring for residential and commercial use under about 30 brand and trade names and under certain private labels. Shaw also provides installation services and sells ceramic and vinyl tile along with sheet vinyl. Shaw�� manufacturing operations are fully integrated from the processing of raw materials used to make fiber through the finishing of carpet. Shaw�� carpet, rugs and hard surface products are sold in a broad range of prices, patterns, colors and textures.

Shaw products are sold wholesale to over 40,000 retailers, distributors and commercial users throughout the United States, Canada and Mexico and are also exported to various overseas markets. Shaw�� wholesale products are marketed domestically by over 2,000 salaried and commissioned sales personnel directly to retailers and distributors and to national accounts. Shaw�� 10 ! car pet f! ull-service distribution facilities, three hard surface! and two ! rug full-service distribution facilities and 24 redistribution centers, along with centralized management information systems, enable it to provide prompt efficient delivery of its products to both its retail customers and wholesale distributors.

Berkshire acquired an 80% interest in IMC International Metalworking Companies B.V. (IMC B.V.). Through its subsidiaries, IMC B.V. is a multinational manufacturers of consumable precision carbide metal cutting tools for applications in a range of industrial end markets under the brand names ISCAR, TaeguTec, Ingersoll, Tungaloy, Unitac, UOP It.te.diand Outiltec. IMC B.V.�� manufacturing facilities are located in Israel, United States, Germany, Italy, France, Switzerland, South Korea, China, India, Japan and Brazil. IMC B.V. has five primary product lines: milling tools, gripping tools, turning/thread tools, drilling tools and tooling. Forest River, Inc. (Forest River) is a manufacturer of recreational vehicles, utilit y, cargo and office trailers, buses and pontoon boats, headquartered in Elkhart, Indiana. Its products are sold in the United States and Canada through an independent dealer network.

Scott Fetzer companies are a diversified group of 20 businesses that manufacture and distribute a variety of products for residential, industrial and institutional use. The two of these businesses are Kirby home cleaning systems and Campbell Hausfeld products. Albecca Inc. (Albecca), headquartered in Norcross, Georgia, does business primarily under the Larson-Juhlname. Albecca designs, manufactures and distributes a complete line of branded custom framing products, including wood and metal moulding, matboard, foamboard, glass, equipment and other framing supplies in the United States, Canada and 15 countries outside of North America. CTB International Corp. is a designer, manufacturer and marketer of systems used in the grain industry and in the production of poultry, hogs a! nd eggs. !

Lubrizol is a specialty chemical company that ! produces ! and supplies technologies for the global transportation, industrial and consumer markets. Lubrizol operates two business sectors: Lubrizol Additives, which includes engine, driveline and industrial additive products and Lubrizol Advanced Materials, which includes personal and home care, engineered polymer and performance coating products. FlightSafety International Inc.(FlightSafety) is engaged primarily in the business of providing high technology training to operators of aircraft. FlightSafety�� training activities include advanced training for pilots of business and commercial aircraft; aircrew training for military and other government personnel; aircraft maintenance technician training; flight attendant and aircraft dispatcher training, and ab-initio (primary) pilot training to qualify individuals for private and commercial pilots��licenses. FlightSafety also develops classroom instructional systems and materials for use in its training business and for sale to othe rs.

NetJets Inc. (NJ) is a provider of fractional ownership programs for general aviation aircraft. TTI, Inc. (TTI) is a global specialty distributor of passive, interconnect, electromechanical and discrete components used by customers in the manufacturing and assembling of electronic products. Business Wire provides electronic dissemination of full-text news releases daily to the media, online services and databases and the global investment community in 150 countries and 45 languages. Berkshire�� retailing businesses principally consist of several independently managed home furnishings and jewelry operations. The home furnishings businesses are the Nebraska Furniture Mart (NFM), R.C. Willey Home Furnishings (R.C. Willey), Star Furniture Company (Star) and Jordan�� Furniture, Inc. (Jordan��). NFM, R.C. Willey, Star and Jordan�� each offer a wide selection of furniture, bedding and accessories. In addition, NFM and R.C. Willey sell a line ! of househ! old a ppliances, electronics, computers and other home furnishings! . NFM, R.! C. Willey, Star and Jordan�� also offer customer financing to complement their retail operations. An important feature of each of these businesses is their ability to control costs and to produce high business volume by offering value to their customers.

NFM operates its business from two retail complexes with almost one million square feet of retail space and sizable warehouse and administrative facilities in Omaha, Nebraska and Kansas City, Kansas. NFM is a furniture retailer in each of its markets. NFM also owns Homemakers Furniture located in Des Moines, Iowa, which has approximately 215,000 square feet of retail space. R.C. Willey, based in Salt Lake City, Utah, is a home furnishings retailer in the Intermountain West region of the United States. R.C. Willey operates 11 retail stores, two retail clearance facilities and three distribution centers. Borsheim Jewelry Company, Inc. (Borsheims) operates from a single store located in Omaha, Nebraska. Borsheim s is a high volume retailer of jewelry, watches, crystal, china, stemware, flatware, gifts and collectibles. Helzberg�� Diamond Shops, Inc. (Helzberg), based in North Kansas City, Missouri, operates a chain of 233 retail jewelry stores in 37 states, which includes approximately 550,000 square feet of retail space. Most of Helzberg�� stores are located in malls, lifestyle centers or power strip centers, and all stores operate under the name Helzberg Diamonds. The Ben Bridge Corporation (Ben Bridge Jeweler), based in Seattle, Washington, operates a chain of 70 upscale retail jewelry stores located in 11 states that are primarily in the Western United States. Three of its locations are concept stores that sell only PANDORA jewelry.

Finance and Financial Products

Clayton Homes, Inc. (Clayton) is a vertically integrated manufactured housing company. At December 31, 2011, Clayton operated 33 manufacturing plants in 12 states. Clay! ton�� h! omes are ma rketed in 48 states through a network of 1,333 retailers, in! cluding 3! 33 Company-owned home centers. Financing is offered through its finance subsidiaries to purchasers of Clayton�� manufactured homes as well as those purchasing homes from selected independent retailers. XTRA Corporation (XTRA), headquartered in St. Louis, Missouri, is a transportation equipment lessor operating under the XTRA Leasebrand name. XTRA manages a diverse fleet of approximately 83,000 units located at 63 facilities throughout the United States and two facilities in Canada. The fleet includes over-the-road and storage traile

Top Insurance Companies To Own For 2014: CNO Financial Group Inc. (CNO)

CNO Financial Group, Inc., through its subsidiaries, engages in the development, marketing, and administration of health insurance, annuity, individual life insurance, and other insurance products for senior and middle-income markets in the United States. The company markets and distributes Medicare supplement insurance, interest-sensitive and traditional life insurance, fixed annuities, and long-term care insurance products; Medicare advantage plans through a distribution arrangement with Humana Inc.; and Medicare Part D prescription drug plans through a distribution and reinsurance arrangement with Coventry Health Care. It also markets and distributes supplemental health, including specified disease, accident, and hospital indemnity insurance products; and life insurance to middle-income consumers at home and the worksite through independent marketing organizations and insurance agencies. In addition, the company markets primarily graded benefit and simplified issue life insurance products directly to customers through television advertising, direct mail, Internet, and telemarketing. It sells its products through career agents, independent producers, direct marketing, and sales managers. CNO Financial Group, Inc. has strategic alliances with Coventry and Humana. The company was formerly known as Conseco, Inc. and changed its name to CNO Financial Group, Inc. in May 2010. CNO Financial Group, Inc. was founded in 1979 and is headquartered in Carmel, Indiana.

Berkshire Hathaway Inc. (Berkshire) is a holding company owning subsidiaries engaged in a number of diverse business activities. The Company is engaged in insurance businesses conducted on both a primary basis and a reinsurance basis. Berkshire also owns and operates a number of other businesses engaged in a variety of activities. On December 30, 2011, Medical Protective Corporation (MedPro) completed the acquisition of 100% of the Princeton Insurance Company, a professional liability insurer for healthcare providers based in Princeton, New Jersey. During the year ended December 31, 2011, Acme Building Brands (Acme) acquired the assets of Jenkins Brick Company, the brick manufacturer in Alabama. In September 2011, Berkshire acquired The Lubrizol Corporation (Lubrizol). In June 2011, the Company acquired Wesco Financial Corporation. In June 2012, Media General, Inc. sold 63 daily and weekly newspapers to World Media Enterprises, Inc., a subsidiary of Berkshire. In July 2012, Berkshire�� The Lubrizol Corporation acquired Lipotec SA.

Insurance and Reinsurance Businesses

Berkshire�� insurance and reinsurance business activities are conducted through numerous domestic and foreign-based insurance entities. Berkshire�� insurance businesses provide insurance and reinsurance of property and casualty risks world-wide and also reinsure life, accident and health risks world-wide. Berkshire�� insurance underwriting operations are consisted of the sub-groups, including GEICO and its subsidiaries, General Re and its subsidiaries, Berkshire Hathaway Reinsurance Group and Berkshire Hathaway Primary Group. GEICO insurance subsidiaries include Government Employees Insurance Company, GEICO General Insurance Company, GEICO Indemnity Company and GEICO Casualty Company. These companies primarily offers private passenger automobile insurance to individuals in all 50 states and the District of Columbia. In addition, GEICO insures motorcycles, all-terrain vehicles, recreational vehicles and s! mall commercial fleets and acts as an agent for other insurers who offer homeowners, boat and life insurance to individuals. GEICO markets its policies primarily through direct response methods in which applications for insurance are submitted directly to the companies through the Internet or by telephone.

General Re Corporation (General Re) is the holding company of General Reinsurance Corporation (GRC) and its subsidiaries and affiliates. GRC�� subsidiaries include General Reinsurance AG, a international reinsurer based in Germany. General Re subsidiaries conduct business activities globally in 51 cities and provide insurance and reinsurance coverages throughout the world. General Re provides property/casualty insurance and reinsurance, life/health reinsurance and other reinsurance intermediary and risk management, underwriting management and investment management services.

Property/Casualty Reinsurance

General Re�� property/casualty reinsurance business in North America is conducted through GRC. Property/casualty operations in North America are also conducted through 16 branch offices in the United States and Canada. Reinsurance activities are marketed directly to clients without involving a broker or intermediary. General Re�� property/casualty business in North America also includes specialty insurers (primarily the General Star and Genesis companies domiciled in Connecticut and Ohio). These specialty insurers underwrite primarily liability and workers��compensation coverages on an excess and surplus basis and excess insurance for self-insured programs. General Re�� international property/casualty reinsurance business operations are conducted through internationally-based subsidiaries on a direct basis (through General Reinsurance AG, as well as several other General Re subsidiaries in 25 countries) and through brokers (primarily through Faraday, which owns the managing agent of Syndicate 435 at Lloyd�� of London and provides capacity and particip! ates in 1! 00% of the results of Syndicate 435).

Life/Health Reinsurance

General Re�� North American and international life, health, long-term care and disability reinsurance coverages are written on an individual and group basis. Most of this business is written on a proportional treaty basis, with the exception of the United States group health and disability business which is predominately written on an excess treaty basis. Lesser amounts of life and disability business are written on a facultative basis. The life/health business is marketed on a direct basis. The Berkshire Hathaway Reinsurance Group (BHRG) operates from offices located in Stamford, Connecticut. Business activities are conducted through a group of subsidiary companies, led by National Indemnity Company (NICO) and Columbia Insurance Company (Columbia). BHRG provides principally excess and quota-share reinsurance to other property and casualty insurers and reinsurers. BHRG�� underwriting activities also include life reinsurance and life annuity business written through Berkshire Hathaway Life Insurance Company of Nebraska and financial guaranty insurance written through Berkshire Hathaway Assurance Corporation.

BHRG writes catastrophe excess-of-loss treaty reinsurance contracts. BHRG also writes individual policies for primarily large or otherwise unusual discrete risks on both an excess direct and facultative reinsurance basis, referred to as individual risk, which includes policies covering terrorism, natural catastrophe and aviation risks. A catastrophe excess policy provides protection to the counterparty from the accumulation of primarily property losses arising from a single loss event or series of related events. Catastrophe and individual risk policies may provide amounts of indemnification per contract and a single loss event may produce losses under a number of contracts. BHRG also underwrites traditional non-catastrophe insurance and reinsurance coverages, referred to as multi-line property/c! asualty b! usiness.

The Berkshire Hathaway Primary Group is a collection of primary insurance operations that provide a variety of insurance coverages to insureds located principally in the United States. NICO and certain affiliates underwrite motor vehicle and general liability insurance to commercial enterprises on both an admitted and excess and surplus basis. This business is written nationwide primarily through insurance agents and brokers and is based in Omaha, Nebraska. U.S. Investment Corporation (USIC), through its three subsidiaries led by United States Liability Insurance Company, is a specialty insurer that underwrites commercial, professional and personal lines of insurance on an admitted and excess and surplus basis. Policies are marketed in all 50 states and the District of Columbia through wholesale and retail insurance agents. USIC companies underwrite and market 109 distinct specialty property and casualty insurance products. Medical Protective Corporation (MedPro) is based in Fort Wayne, Indiana. Through its subsidiary, the Medical Protective Company, MedPro is engaged in primary medical professional liability coverage and risk solutions to physicians, dentists, other healthcare providers and healthcare facilities.

Railroad Business

Through BNSF Railway, BNSF operates a railroad network in North America with approximately 32,000 route miles of track (excluding multiple main tracks, yard tracks and sidings) in 28 states and two Canadian provinces as of December 31, 2011. BNSF owns approximately 23,000 route miles, including easements, and operates on approximately 9,000 route miles of trackage rights that permit BNSF to operate its trains with its crews over other railroads��tracks. As of December 31, 2011, the total BNSF Railway system, including single and multiple main tracks, yard tracks and sidings, consisted of approximately 50,000 operated miles of track, all of which are owned by or held under easement by BNSF except for approximately 10,000 route! miles op! erated under trackage rights.

BNSF is based in Fort Worth, Texas, and through BNSF Railway Company operates railroad systems in North America. In serving the Midwest, Pacific Northwest, Western, Southwestern and Southeastern regions and ports of the country, BNSF transports a range of products and commodities derived from manufacturing, agricultural and natural resource industries. In serving the Midwest, Pacific Northwest, Western, Southwestern and Southeastern regions and ports of the country, BNSF transports a range of products and commodities derived from manufacturing, agricultural and natural resource industries. Over half of the freight revenues of BNSF are covered by contractual agreements of varying durations. BNSF�� primary routes, including trackage rights, allow it to access cities and ports in the western and southern United States as well as parts of Canada and Mexico. In addition to cities and ports, BNSF efficiently serves many smaller markets by working closely with approximately 200 shortline partners. BNSF has also entered into marketing agreements with other rail carriers, expanding the marketing reach for each railroad and their customers.

Utilities and Energy Businesses

MidAmerican�� businesses are managed as separate operating units. MidAmerican�� domestic regulated energy interests are comprised of two regulated utility companies serving more than three million retail customers and two interstate natural gas pipeline companies with approximately 16,600 miles of pipeline and a design capacity of approximately 7.7 billion cubic feet of natural gas per day. Its United Kingdom electricity distribution subsidiaries serve about 3.9 million electricity end-users. In addition, MidAmerican�� interests include a diversified portfolio of domestic independent power projects, a hydroelectric facility in the Philippines and residential real estate brokerage firm in the United States.

PacifiCorp is a regulated electric utility compa! ny headqu! artered in Oregon, serving regulated retail electric customers in portions of Utah, Oregon, Wyoming, Washington, Idaho and California. The combined service territory�� diverse regional economy ranges from rural, agricultural and mining areas to urban, manufacturing and government service centers. As a vertically integrated electric utility, PacifiCorp owns approximately 10,600 net megawatts of generation capacity. MidAmerican Energy Company (MEC) is a regulated electric and natural gas utility company headquartered in Iowa, serving regulated retail electric and natural gas customers primarily in Iowa and also in portions of Illinois, South Dakota and Nebraska. MEC has a diverse customer base consisting of residential, agricultural and a variety of commercial and industrial customer groups. In addition to retail sales and natural gas transportation, MEC sells regulated electricity to markets operated by regional transmission organizations and regulated electricity and natural gas to other utilities and market participants on a wholesale basis and sells non-regulated electricity and natural gas services in deregulated markets. As a vertically integrated electric and gas utility, MEC owns approximately 7,000 net megawatts of generation capacity.

The natural gas pipelines consist of Northern Natural Gas Company (Northern Natural) and Kern River Gas Transmission Company (Kern River). Northern Natural is based in Nebraska and owns interstate natural gas pipeline systems in the United States reaching from southern Texas to Michigan�� Upper Peninsula. Northern Natural�� pipeline system consists of approximately 14,900 miles of natural gas pipelines. Northern Natural has access to supplies from mid-continent basin and provides transportation services to utilities and numerous other customers. Northern Natural also operates three underground natural gas storage facilities and two liquefied natural gas storage peaking units.

Kern River is based in Utah and owns an interstate natural! gas pipe! line system that consists of approximately 1,700 miles and extends from the supply areas in the Rocky Mountains to consuming markets in Utah, Nevada and California. Kern River transports natural gas for electric utilities and natural gas distribution utilities, oil and natural gas companies or affiliates of such companies, electricity generating companies, energy marketing and trading companies, and financial institutions. The United Kingdom utilities consist of Northern Powergrid (Northeast) Limited (Northern Powergrid (Northeast)) and Northern Powergrid (Yorkshire) plc (Northern Powergrid (Yorkshire)), which own a substantial United Kingdom electricity distribution network that delivers electricity to end-users in northeast England in an area covering approximately 10,000 square miles. The distribution companies primarily charge supply companies regulated tariffs for the use of electrical infrastructure. MidAmerican also owns HomeServices of America, Inc. (HomeServices), a full-service residential real estate brokerage firm in the United States. HomeServices also offers integrated real estate services, including mortgage originations through a joint venture, title and closing services, property and casualty insurance, home warranties, relocation services and other home-related services. It operates under 22 residential real estate brand names with over 14,000 sales associates and in nearly 300 brokerage offices in 20 states.

Manufacturing, Service and Retailing Businesses

Berkshire�� numerous and diverse manufacturing, service and retailing businesses. Marmon consists of approximately 140 manufacturing and service businesses that operate independently within eleven diverse, stand-alone business sectors. These sectors are Building Wire, Crane Services, Distribution Services, Engineered Wire and Cable, Flow Products, Food Service Equipment, Highway Technologies, Industrial Products, Retail Store Fixtures, Transportation Services and Engineered Products and Water Treatment.

! Building Wire, providing copper electrical building wire for residential, commercial and industrial construction. Crane Services provides the leasing and operation of mobile cranes primarily to the energy, mining and petrochemical markets. Distribution Services, supplying specialty metal pipe and tubing, bar and sheet products to markets including construction, industrial, aerospace and many others. Engineered Wire & Cable, providing electrical and electronic wire and cable for energy related markets and other industries. Flow Products is producing copper tube for the plumbing, heating, ventilation, and air conditioning (HVAC), refrigeration, and industrial markets. Food Service Equipment is supplying commercial food preparation equipment for restaurants and shopping carts for retail stores. Highway Technologies, primarily serving the heavy-duty highway transportation industry with trailers, fifth wheel coupling devices and undercarriage products such as brake parts and suspension systems, and also serving the light vehicle aftermarket with clutches and related products.

Industrial Products, consisting of metal fasteners for the building, furniture, cabinetry, industrial and other markets, gloves for industrial markets, portable lighting equipment for mining and safety markets, overhead electrification equipment for mass transit systems, custom-machined brass, aluminum and copper forgings for the construction, valve and other industries, brass fittings and valves for commercial and industrial applications, and drawn aluminum tubing and extruded aluminum shapes for the construction, automotive, appliance, medical and other markets . Retail Store Fixtures, providing shelving and other merchandising displays and related services for retail stores worldwide. Transportation Services & Engineered Products, including manufacturing, leasing and maintenance of railroad tank cars, leasing of intermodal tank containers, in-plant rail services, manufacturing of bi-modal railcar movers, wheel, axle ! and gear ! sets for light rail transit and gear products for locomotives, manufacturing of steel tank heads, and services, equipment and technology for processing and distributing sulfur. Water Treatment, equipment including residential water softening, purification and refrigeration filtration systems, treatment systems for industrial markets including power generation, oil and gas, chemical, and pulp and paper, gear drives for irrigation systems and cooling towers, and air-cooled heat exchangers. Marmon operates approximately 300 manufacturing, distribution and service facilities that are primarily located in North America, Europe and China, and employs more than 16,000 people worldwide.

McLane Company, Inc. (McLane) provides wholesale distribution and logistics services in all 50 states and internationally in Brazil to customers that include discount retailers, convenience stores, wholesale clubs, quick service restaurants, drug stores and military bases. Operations are divided into five business units: grocery distribution, foodservice distribution, beverage distribution, international logistics and software development. McLane�� foodservice distribution unit, based in Carrollton, Texas, focuses on serving the quick service restaurant industry. Operations are conducted through 18 facilities in 16 states. The foodservice distribution unit services more than 20,000 chain restaurants nationwide.

Other Manufacturing, Other Service and Retailing Businesses

Berkshire�� apparel manufacturing businesses include manufacturers of a variety of clothing and footwear. Businesses engaged in the manufacture and distribution of clothing products include Fruit of the Loom, Inc. (Fruit), Russell Brands, LLC (Russell), Vanity Fair Brands, LP (VFB), Garan and Fechheimer Brothers. Berkshire�� footwear businesses include H.H. Brown Shoe Group, Justin Brands and Brooks Athletic. Fruit, Russell and VFB (together FOL) is primarily a vertically integrated manufacturer and distributor of ba! sic appar! el, underwear and athletic apparel and products. Products, under the Fruit of the Loomand JERZEES labels are primarily sold in the mass merchandise and wholesale markets. In the VFB product line, Vassarette, Bestformand Curvationare sold in the mass merchandise market, while Vanity Fairand Lily of Franceproducts are sold in the mid-tier chains and department stores. FOL also markets and sells athletic uniforms, apparel, sports equipment and balls to team dealers; college licensed tee shirts and fleecewear to college bookstores and mid-tier merchants; and athletic apparel, sports equipment and balls to sporting goods retailers under the Russell Athleticand Spaldingbrands. Additionally, Spaldingmarkets and sells balls in the mass merchandise market and dollar store channel. During the year ended December, 31, 2011, approximately 30% of FOL�� sales were to Wal-Mart. FOL generally performs its own spinning, knitting, cloth finishing, cutting, sewing and packaging.

Garan designs, manufactures, imports and sells apparel primarily for children, including boys, girls, toddlers and infants. Products are sold under its own trademark Garanimalsand private labels of its customers. Garan also licenses its registered trademark Garanimalsto independent third parties. Garan conducts its business through operating subsidiaries located in the United States, Central America and Asia. Substantially all of Garan�� products are sold through its distribution centers in the United States to national chain stores, department stores and specialty stores. In 2011, over 90% of Garan�� sales were to Wal-Mart. Fechheimer Brothers manufactures, distributes and sells uniforms, principally for the public service and safety markets, including police, fire, postal and military markets. Fechheimer Brothers is based in Cincinnati, Ohio.

Justin Brands and H.H. Brown Shoe Group manufacture and distribute work, rugged outdoor and casual shoes and western-style footwear under a number of brand names, including! Justin, ! Tony Lama, Nocona, Chippewas, Born, Sofft, Carolina, Double-H Boots, Corcoran, Matterhornand Kork-Ease. Brooks Athletic markets and sells running footwear to specialty retailers under Brooksbrand. In 2011, Brooksachieved #1 market share in footwear with specialty retailers. A volume of the shoes sold by Berkshire�� shoe businesses are manufactured or purchased from sources outside the United States. Products are principally sold in the United States through a variety of channels including department stores, footwear chains, specialty stores, catalogs and the Internet, as well as through Company-owned retail stores.

Acme manufactures and distributes clay bricks (Acme Brickand Jenkins Brick), concrete block (Featherlite) and cut limestone (Texas Quarries). In addition, Acme distributes a number of other building products of other manufacturers, including glass block, floor and wall tile and other masonry products. Acme also sells ceramic floor and wall tile, as well as marble, granite and other stones through its subsidiary, American Tile and Stone. Products are sold primarily in the South Central and South Eastern United States through Company-operated sales offices. Acme distributes products primarily to homebuilders and masonry and general contractors.

Benjamin Moore & Co. (Benjamin Moore) is a formulator, manufacturer and retailer of a range of architectural coatings, available principally in the United States and Canada. Products include water-thinnable and solvent-thinnable general purpose coatings (paints, stains and clear finishes) for use by the general public, contractors and industrial and commercial users. Products are marketed under various registered brand names, including Regal, Superspec, Moorcraft, Moorgard, Aura, Nattura, ben, Coronado Paint, Insl-xand Lenmar.

Benjamin Moore and its manufacturing subsidiaries rely primarily on an independent dealer network for the distribution of its products. Its distribution network includes approximately 100! Company-! owned stores as well as over 4,500 third party retailers representing over 10,300 storefronts in the United States and Canada. Benjamin Moore�� Company-owned stores represent several multiple-outlet and stand-alone retailers in various parts of the United States and Canada serving primarily contractors and general consumers. The independent retailer channel offers an array of products including Benjamin Mooreand Insl-xbrands and other competitor coatings, wallcoverings, window treatments and sundries. Benjamin Moore also has three color stations located in regional malls that serve as brand marketing tools. In addition to the independent retailer channel, Benjamin Moore has recently begun to sell direct to the consumer through e-commerce sites and its customer care program, which includes national accounts and government agencies.

Johns Manville (JM) is a manufacturer and marketer of products for building insulation, mechanical insulation, commercial roofing and roof insulation, as well as fibers and nonwovens for commercial, industrial and residential applications. JM serves markets that include aerospace, automotive and transportation, air handling, appliance, HVAC, pipe and equipment filtration, waterproofing, building, flooring, interiors and wind energy. Fiber glass is the basic material in a majority of JM�� products, although JM also manufactures a portion of its products with other materials to satisfy the broader needs of its customers. JM regards its patents and licenses as valuable, however it does not consider any of its businesses to be materially dependent on any single patent or license. JM is headquartered in Denver, Colorado, and operates 40 manufacturing facilities in North America, Europe and China and conducts research and development at several other facilities. JM sells its products through a variety of channels, including contractors, distributors, retailers, manufacturers and fabricators.

MiTek is a provider of engineered connector products, engine! ering sof! tware and services and computer-driven manufacturing machinery to the truss fabrication segment of the building components industry. Primary customers are truss fabricators who manufacture pre-fabricated roof and floor trusses and wall panels for the residential building market, as well as the light commercial and institutional construction industry. MiTek also participates in the light gauge steel framing market under the Ultra-Spanname, manufactures and markets assembly line machinery used by the lead acid battery industry, manufactures and markets a line of masonry connector products and manufactures and markets air handling systems used in commercial building. MiTek operates on six continents with sales into approximately 90 countries. MiTek has 34 manufacturing facilities located in eleven countries and 45 sales/engineering offices located in 17 countries.

The Shaw Industries Group, Inc. (Shaw) is a carpet manufacturer based on both revenue and volume of production. Shaw designs and manufactures over 3,000 styles of tufted carpet, tufted and woven rugs, laminate and wood flooring for residential and commercial use under about 30 brand and trade names and under certain private labels. Shaw also provides installation services and sells ceramic and vinyl tile along with sheet vinyl. Shaw�� manufacturing operations are fully integrated from the processing of raw materials used to make fiber through the finishing of carpet. Shaw�� carpet, rugs and hard surface products are sold in a broad range of prices, patterns, colors and textures.

Shaw products are sold wholesale to over 40,000 retailers, distributors and commercial users throughout the United States, Canada and Mexico and are also exported to various overseas markets. Shaw�� wholesale products are marketed domestically by over 2,000 salaried and commissioned sales personnel directly to retailers and distributors and to national accounts. Shaw�� 10 carpet full-service distribution facilities, three hard surface an! d two rug! full-service distribution facilities and 24 redistribution centers, along with centralized management information systems, enable it to provide prompt efficient delivery of its products to both its retail customers and wholesale distributors.

Berkshire acquired an 80% interest in IMC International Metalworking Companies B.V. (IMC B.V.). Through its subsidiaries, IMC B.V. is a multinational manufacturers of consumable precision carbide metal cutting tools for applications in a range of industrial end markets under the brand names ISCAR, TaeguTec, Ingersoll, Tungaloy, Unitac, UOP It.te.diand Outiltec. IMC B.V.�� manufacturing facilities are located in Israel, United States, Germany, Italy, France, Switzerland, South Korea, China, India, Japan and Brazil. IMC B.V. has five primary product lines: milling tools, gripping tools, turning/thread tools, drilling tools and tooling. Forest River, Inc. (Forest River) is a manufacturer of recreational vehicles, utility, cargo and office trailers, buses and pontoon boats, headquartered in Elkhart, Indiana. Its products are sold in the United States and Canada through an independent dealer network.

Scott Fetzer companies are a diversified group of 20 businesses that manufacture and distribute a variety of products for residential, industrial and institutional use. The two of these businesses are Kirby home cleaning systems and Campbell Hausfeld products. Albecca Inc. (Albecca), headquartered in Norcross, Georgia, does business primarily under the Larson-Juhlname. Albecca designs, manufactures and distributes a complete line of branded custom framing products, including wood and metal moulding, matboard, foamboard, glass, equipment and other framing supplies in the United States, Canada and 15 countries outside of North America. CTB International Corp. is a designer, manufacturer and marketer of systems used in the grain industry and in the production of poultry, hogs and eggs.

Lubrizol is a specialty chemical company that pro! duces and! supplies technologies for the global transportation, industrial and consumer markets. Lubrizol operates two business sectors: Lubrizol Additives, which includes engine, driveline and industrial additive products and Lubrizol Advanced Materials, which includes personal and home care, engineered polymer and performance coating products. FlightSafety International Inc.(FlightSafety) is engaged primarily in the business of providing high technology training to operators of aircraft. FlightSafety�� training activities include advanced training for pilots of business and commercial aircraft; aircrew training for military and other government personnel; aircraft maintenance technician training; flight attendant and aircraft dispatcher training, and ab-initio (primary) pilot training to qualify individuals for private and commercial pilots��licenses. FlightSafety also develops classroom instructional systems and materials for use in its training business and for sale to others.

NetJets Inc. (NJ) is a provider of fractional ownership programs for general aviation aircraft. TTI, Inc. (TTI) is a global specialty distributor of passive, interconnect, electromechanical and discrete components used by customers in the manufacturing and assembling of electronic products. Business Wire provides electronic dissemination of full-text news releases daily to the media, online services and databases and the global investment community in 150 countries and 45 languages. Berkshire�� retailing businesses principally consist of several independently managed home furnishings and jewelry operations. The home furnishings businesses are the Nebraska Furniture Mart (NFM), R.C. Willey Home Furnishings (R.C. Willey), Star Furniture Company (Star) and Jordan�� Furniture, Inc. (Jordan��). NFM, R.C. Willey, Star and Jordan�� each offer a wide selection of furniture, bedding and accessories. In addition, NFM and R.C. Willey sell a line of household appliances, electronics, computers and other home furnishings. N! FM, R.C. ! Willey, Star and Jordan�� also offer customer financing to complement their retail operations. An important feature of each of these businesses is their ability to control costs and to produce high business volume by offering value to their customers.

NFM operates its business from two retail complexes with almost one million square feet of retail space and sizable warehouse and administrative facilities in Omaha, Nebraska and Kansas City, Kansas. NFM is a furniture retailer in each of its markets. NFM also owns Homemakers Furniture located in Des Moines, Iowa, which has approximately 215,000 square feet of retail space. R.C. Willey, based in Salt Lake City, Utah, is a home furnishings retailer in the Intermountain West region of the United States. R.C. Willey operates 11 retail stores, two retail clearance facilities and three distribution centers. Borsheim Jewelry Company, Inc. (Borsheims) operates from a single store located in Omaha, Nebraska. Borsheims is a high volume retailer of jewelry, watches, crystal, china, stemware, flatware, gifts and collectibles. Helzberg�� Diamond Shops, Inc. (Helzberg), based in North Kansas City, Missouri, operates a chain of 233 retail jewelry stores in 37 states, which includes approximately 550,000 square feet of retail space. Most of Helzberg�� stores are located in malls, lifestyle centers or power strip centers, and all stores operate under the name Helzberg Diamonds. The Ben Bridge Corporation (Ben Bridge Jeweler), based in Seattle, Washington, operates a chain of 70 upscale retail jewelry stores located in 11 states that are primarily in the Western United States. Three of its locations are concept stores that sell only PANDORA jewelry.

Finance and Financial Products

Clayton Homes, Inc. (Clayton) is a vertically integrated manufactured housing company. At December 31, 2011, Clayton operated 33 manufacturing plants in 12 states. Clayton�� homes are marketed in 48 states through a network of 1,333 retailers, inclu! ding 333 ! Company-owned home centers. Financing is offered through its finance subsidiaries to purchasers of Clayton�� manufactured homes as well as those purchasing homes from selected independent retailers. XTRA Corporation (XTRA), headquartered in St. Louis, Missouri, is a transportation equipment lessor operating under the XTRA Leasebrand name. XTRA manages a diverse fleet of approximately 83,000 units located at 63 facilities throughout the United States and two facilities in Canada. The fleet includes over-the-road and storage traile

Advisors' Opinion: - [By Buffett]

Berkshire Hathaway (BRK-B) -- could be one such value play right now. Suppressed by weakness in its industry and exposure to troubled financial stocks, among other things, these class B shares have slipped 13% from their 2011 closing high on Feb. 28 to trade recently for around $76. (Class A shares, which go for more than $110,000 each, have been equally weak.)

At current prices, the stock trades about 30% below intrinsic value -- the true value of all its businesses combined -- estimates Whitney Tilson of T2 Partners, a hedge fund that owns Berkshire shares. "It's just about the cheapest we've ever seen it," says Tilson. Buffett himself, and his longtime investing partner Charlie Munger, have been publicly dropping hints that their stock might be a good buy now, says Pat Dorsey, director of research and strategy at Sanibel Captiva Trust.

But there are a lot of investments wrapped into Berkshire, so it's worth looking under the hood for the solid core of the master's stock portfolio. Following is a look at seven of Buffett's best stock plays, why he owns them and why they make sense as buys if a weak market lies ahead.

Top Insurance Companies To Own For 2014: MGIC Investment Corp (MTG)

MGIC Investment Corporation (MGIC), incorporated June 21, 1984, is a holding company and through wholly owned subsidiaries is a private mortgage insurer in the United States. As of December 31, 2012, its principal mortgage insurance subsidiaries, Mortgage Guaranty Insurance Corporation (MGIC) and MGIC Indemnity Corporation (MIC), were each licensed in all 50 states of the United States, the District of Columbia and Puerto Rico. During the year ending December 31, 2012, the Company wrote new insurance in each of those jurisdictions in MGIC and/or MIC. The Company capitalized MIC to write new insurance in certain jurisdictions where MGIC no longer meets, and is unable to obtain a waiver of, those jurisdictions��minimum capital requirements. Private mortgage insurance covers losses from homeowner defaults on residential mortgage loans, reducing and, in some instances, eliminating the loss to the insured institution if the homeowner defaults.

Mortgage Insurance

Primary insurance provides mortgage default protection on individual loans and covers unpaid loan principal, delinquent interest and certain expenses associated with the default and subsequent foreclosure. Primary insurance is written on first mortgage loans secured by owner occupied single-family homes, which are one-to-four family homes and condominiums. Primary insurance is also written on first liens secured by non-owner occupied single-family homes, which are referred to in the home mortgage lending industry as investor loans, and on vacation or second homes. Primary coverage can be used on any type of residential mortgage loan instrument approved by the mortgage insurer.

When a borrower refinances a mortgage loan insured by the Company by paying it off in full with the proceeds of a new mortgage that is also insured by it, the insurance on that existing mortgage is cancelled, and insurance on the new mortgage is considered to be new primary insurance written. Therefore, continuation of its coverage fr! om a refinanced loan to a new loan results in both a cancellation of insurance and new insurance written. When a lender and borrower modify a loan rather than replace it with a new one, or enter into a new loan pursuant to a loan modification program, its insurance continues without being cancelled assuming that the Company consent to the modification or new loan.

The borrower�� mortgage loan instrument requires the borrower to pay the mortgage insurance premium. There are several payment plans available to the borrower, or lender, as the case may be. Under the monthly premium plan, the borrower or lender pays it a monthly premium payment to provide only one month of coverage. Under the annual premium plan, an annual premium is paid to it in advance, and it earns and recognizes the premium over the next 12 months of coverage, with annual renewal premiums paid in advance thereafter and earned over the subsequent 12 months of coverage. Under the single premium plan, the borrower or lender pays it a single payment covering a specified term exceeding twelve months.

Pool insurance is used as an additional credit enhancement for certain secondary market mortgage transactions. Pool insurance covers the excess of the loss on a defaulted mortgage loan which exceeds the claim payment under the primary coverage, if primary insurance is required on that mortgage loan, as well as the total loss on a defaulted mortgage loan which did not require primary insurance. Pool insurance is used as an additional credit enhancement for certain secondary market mortgage transactions. Pool insurance covers the excess of the loss on a defaulted mortgage loan, which exceeds the claim payment under the primary coverage, if primary insurance is required on that mortgage loan, as well as the total loss on a defaulted mortgage loan which did not require primary insurance. In general, the loans insured by it in Wall Street bulk transactions consisted of loans with reduced underwriting documentation; cash out! refinanc! es, which exceed the standard underwriting requirements of the Federal National Mortgage Association (Fannie Mae) and Federal Home Loan Mortgage Corporation (Freddie Mac) (collectively GSEs); A- loans; subprime loans, and jumbo loans.

Other Products and Services

The Company has participated in risk sharing arrangements with the GSEs and captive mortgage reinsurance arrangements with subsidiaries of certain mortgage lenders, which reinsure a portion of the risk on loans originated or serviced by the lenders, which have MGIC primary insurance. It provides information regarding captive mortgage reinsurance arrangements to the New York Department of Insurance (known as the New York Department of Financial Services), the Minnesota Department of Commerce and the Department of Housing and Urban Development, (HUD). It performs contract underwriting services for lenders, in which it judges whether the data relating to the borrower and the loan contained in the lender�� mortgage loan application file comply with the lender�� loan underwriting guidelines. It also provides an interface to submit data to the automated underwriting systems of the GSEs, which independently judge the data. These services are provided for loans, which require private mortgage insurance, as well as for loans that do not require private mortgage insurance. It provides mortgage services for the mortgage finance industry, such as portfolio retention and secondary marketing of mortgages.

The Company competes with Federal Housing Administration, Veterans Administration, PMI Mortgage Insurance Company, Genworth Mortgage Insurance Corporation, United Guaranty Residential Insurance Company, Radian Guaranty Inc., CMG Mortgage Insurance Company, and Essent Guaranty, Inc.

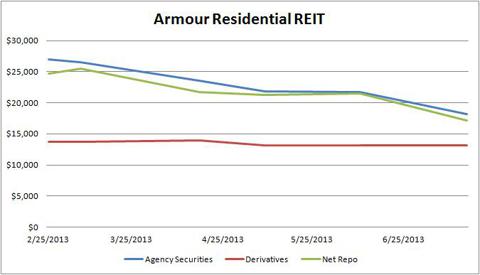

We can see that, as I suggested earlier, during the recent rise in interest rates, which started at the beginning of May, Agency securities have in fact declined in the portfolio holdings quite a bit. At the same time, Repo has declined. The value of the derivatives however have stayed rela! tively co! nstant throughout the entire period. The graph below show the percent of derivatives to Agency securities.

We can see that, as I suggested earlier, during the recent rise in interest rates, which started at the beginning of May, Agency securities have in fact declined in the portfolio holdings quite a bit. At the same time, Repo has declined. The value of the derivatives however have stayed rela! tively co! nstant throughout the entire period. The graph below show the percent of derivatives to Agency securities. As we can see in the graph, the amount of derivatives per Agency security is increasing. In February ARR held around half of the total value of their Agency securities in derivatives, as of the most recent report in July ARR holds over 70% of the value of their Agency securities in derivatives.

As we can see in the graph, the amount of derivatives per Agency security is increasing. In February ARR held around half of the total value of their Agency securities in derivatives, as of the most recent report in July ARR holds over 70% of the value of their Agency securities in derivatives.